There are no guarantees and you could risk running out of money if you get it wrong. Many different types of investment risk could apply depending on your choices. The level of risk is determined by how you choose to invest the funds.

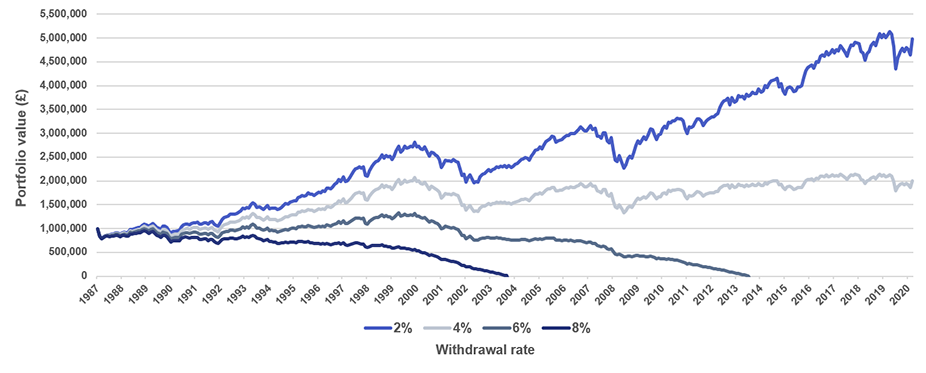

It has statutory protection to 90% of its total value and inflation is the main threat, as income is payable for life. If you value certainty in the future, with a guaranteed income for the rest of your life, an annuity holds much lower levels of risk. When you choose to buy an annuity with your pension fund, you exchange the pension pot for the promise of a lifetime income and any investment value ceases.Īs you are withdrawing income directly from your pension pot, there is the potential for your pension pot to grow, if investment returns are greater than the income you withdraw. Your income withdrawals can also be flexible and can be increased or reduced depending on how the fund is performing. If you withdraw too much too soon, it could run out. You can draw an income from your pension pot, but it is up to you to ensure it lasts for the rest of your life. Once you have purchased an annuity, you will have bought a guaranteed income until you die. Investment risk – the value of your pension pot could go up or down depending on investment performance.No guarantees – it is your responsibility to ensure your pension pot lasts for the rest of your life.Any proceeds on death are likely to be outside your estate for Inheritance Tax calculation purposes if you have signed a valid nomination of benefits.Generally considered more flexible than an annuity – you can change how much you withdraw and can purchase an annuity at a later date if desired.There is potential for your pension pot to grow more after you reach retirement age.You can invest in a wide range of assets but if growth disappoints or you draw too much, or a combination of the two, it could result in you running out of money. You can vary your income over time to suit your circumstances. If you choose drawdown, then you give up future certainty for flexibility. However, as with any investment, there is a risk that it could go down in value as well as up. Pension drawdown allows you to draw an income from your pension while the balance remains invested and able to grow. As there is no pension pot there is no value to pass to your family or other beneficiaries unless you buy protection at outset and then payments will be determined by how long you live.Unlike drawdown, there is no investment value and therefore no pension pot to benefit from growth.Less flexible - you can’t change the shape of your income or switch provider once you have purchased an annuity.Capital protection options are available.Option to protect your partner on death by purchasing a joint annuity so your partner carries on receiving a proportion of the payments after your death.Financial certainty and security – the amount you receive regularly will be certain from outset.A guaranteed income for the rest of your life.A financial adviser can take you through the different products that are available and help you choose the right one. They can vary significantly and rarely will your existing pension provider offer the best rate.Īs you cannot change your mind once you have purchased an annuity, you should shop around to ensure you make the right decision. The more certainty you want, the more expensive the annuity and therefore the lower the starting income.ĭo not buy directly from your pension provider until you have reviewed rates in the open market. You can also buy capital protection on early death, either by purchasing a fixed period of payments or protecting the original purchase price. You can purchase protection against future inflation by having income increase by a fixed amount annually or perhaps an inflation-related measure like the Consumer Prices Index (CPI). It provides you with a fixed, regular income for the rest of your life. AnnuitiesĪn annuity is a financial product that you buy with your pension pot. Drawdown can see your pension pot increase if investments do well, but you also run the risk of it falling in value and you could run out of money before you die.īelow you can read about annuity and drawdown in more detail and view our comparison table. An annuity provides valuable certainty for the rest of your life, no matter how long you live, meaning there is less risk involved. It depends on your situation and many other factors. If you choose drawdown, you withdraw money from your pension pot, the remainder stays invested and can go up and down in value. When you purchase an annuity, you usually receive a set income for life. What’s the difference between an annuity and drawdown?Īnnuity and drawdown are the two main options for drawing money from your pension.

0 kommentar(er)

0 kommentar(er)